PIB ANALYSIS FOR UPSC CIVIL SERVICES EXAM 2018

Topics Covered

- National Medical Devices Promotion Council

- E-Commerce Portal of the Department of Posts (DoP)

- How Indian Navy give Names to its Vessels

- ECO Niwas Samhita 2018

- Based on the Questions asked in the Parliament

- Year End Reviews

1 . National Medical Devices Promotion Council

National Medical Devices Promotion Council to be set up under DIPP

Background

- To give a fillip to the medical device sector, which is a sunrise sector, Union Minister of Commerce and Industry and Civil Aviation, Suresh Prabhu, announced setting up of a National Medical Devices Promotion Council under the Department of Industrial Policy and Promotion (DIPP) in the Ministry of Commerce & Industry.

- The Medical Devices Industry (MDI) plays a critical role in the healthcare ecosystem and is indispensable to achieve the goal of health for all citizens of the country.

- The manufacturing and trade in MDI is growing steadily which includes a wide range of products. Although the industry has been growing in double digits but is predominantly import-driven with imports accounting for over 65% of the domestic market.

- As Indian manufacturing companies and startups move towards creating innovative products, the setting-up of the Council will spur domestic manufacturing in this sector.

Composition of the Council

- The Council will be headed by Secretary, DIPP. Apart from the concerned departments of Government of India, it will also have representatives from health care industry and quality control institutions. Andhra Pradesh MedTech Zone, Visakhapatnam, will provide technical support to the Council.

Objectives of the Council

- Act as a facilitating and promotion & developmental body for the Indian MDI.

- Hold periodic seminars, workshops and all related networking activities to garner views of the industry and understand best global practices in the sector and deliberate on various parameters for inclusion in the industrial and trade policies in medical devices.

- Identify redundant processes and render technical assistance to the agencies and departments concerned to simplify the approval processes involved in medical device industry promotion & development.

- Enable entry of emerging interventions and support certifications for manufacturers to reach levels of global trade norms and lead India to an export driven market in the sector.

- Support dissemination and documentation of international norms and standards for medical devices, by capturing the best practices in the global market and facilitate domestic manufacturers to rise to international level of understanding of regulatory and non regulatory needs of the industry.

- Drive a robust and dynamic Preferential Market Access (PMA) policy, by identifying the strengths of the Indian manufacturers and discouraging unfair trade practices in imports; while ensuring pro-active monitoring of public procurement notices across India to ensure compliance with PMA guidelines of DIPP and DoP.

- Undertake validation of Limited Liability Partnerships (LLPs) and other such entities within MDI sector, which add value to the industry strength in manufacturing to gain foothold for new entrants.

- Make recommendations to government based on industry feedback and global practices on policy and process interventions to strengthen the medical technology sector, including trade interventions for related markets.

2 . E-Commerce Portal of the Department of Posts (DoP)

“lndia Post ventures into new arena of e-market place to provide end to end support to rural artisans and online retailers to sell their products using e-Commerce portal of DoP”

- The Portal will provide an e-Market place to sellers especially to rural artisans / self-help groups / women entrepreneurs / State and Central PSUs / Autonomous Bodies etc. to sell their products to buyers across the Country.

- The small and local sellers, who have been left behind in e-Commerce space will now, by leveraging the vast physical and lT network of DoP, be able to maximize their reach and retailing power.

- The buyers can access the products of their choice displayed by sellers on the portal and place online orders by making digital payments.

- The products will be shipped through Speed Post.

Deen Dayal SPARSH (i.e Scholarship for Promotion of Aptitude & Research in Stamps as a Hobby).

- With the objective of bringing philately to the mainstream of the education system and incentivizing it, in 2017, Department of Posts had launched a scholarship program for school children called Deen Dayal SPARSH

Meghdoot Awards

- Meghdoot Awards are given to the Gramin Dak Sewak (GDS) and employees of the Department in eight categories in recognition of their outstanding contribution

- Each of the 8 awards carries a cash award of Rs. 21,000, a gold medallion and a citation.

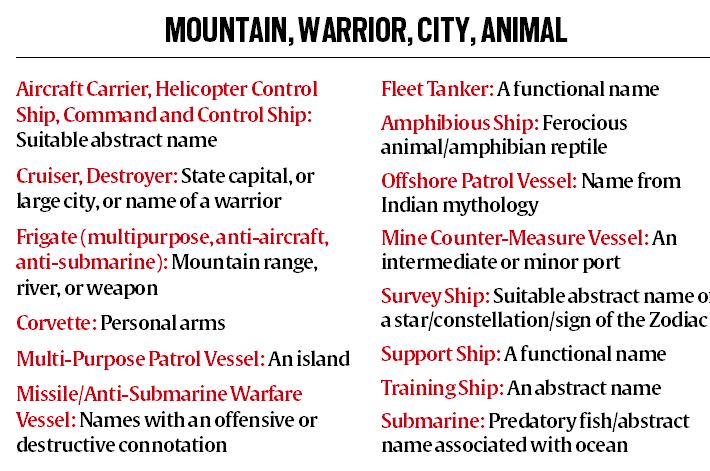

3 . How Indian Navy give Names to its Vessels

4 . ECO Niwas Samhita 2018

ECO Niwas Samhita 2018 – an Energy Conservation Building Code for Residential Buildings launched

Implementation of this Code expected to save 125 Billion Units of electricity per year by 2030, which is equivalent to 100 million ton of CO2 emission

26 industrial units get National Energy Conservation Awards for excellent performance in energy efficiency; 19 school children win National Painting Competition prizes

About Eco Niwas Samhita

- ECO Niwas Samhita 2018,an Energy Conservation Building Code for Residential Buildings (ECBC-R).TheCode was launched on the occasion of National Energy Conservation Day 2018

- The implementation of this Code will give a fillip to energy efficiency in residential sector. It aims to benefit the occupants and the environment by promoting energy efficiency in design and construction of homes, apartments and townships.

- The parameters listed in the Code have been developed based on large number of parameters using climate and energy related data.

- Initially, Part-I of the Code has been launched which prescribes minimum standards for building envelope designs with the purpose of designing energy efficient residential buildings.

- The Code is expected to assist large number of architects and builders who are involved in design and construction of new residential complexes in different parts of the country.

- Implementation of this Code will have potential for energy savings to the tune of 125 Billion Units of electricity per year by 2030, which is equivalent to about 100 million ton of Co2 emission.

National Energy Conservation Awards

- National Energy Conservation Day is celebrated every year on 14th December by Ministry of Power in association with Bureau of Energy Efficiency.

- In order to recognise the efforts of industry and other establishments towards promoting energy efficiency, on this Day, Ministry of Power organizes National Energy Conservation Awards event every year.

- In order to raise the awareness about energy efficiency and energy conservation, the Ministry of Power also organises National Painting Competition.

About Bureau of Energy Efficiency (BEE)

- BEE is a statutory body under Ministry of Power which is mandated to implement policy and programmes in the area of energy efficiency and conservation.

- The objective of such initiatives is to reduce energy intensity in our country by optimizing energy demand and reduce emissions of greenhouse gases (GHG) which are responsible for global warming and climate change.

- India has committed to reduction of 33-35% GHG emission by 2030 as part of the document submitted to UNFCCC.

5 . Based on Questions Asked in the Parliament

Socially oriented Insurance Schemes

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- The cover period under these schemes is 1st June of each year to 31st May of subsequent year.

- These schemes are offered/ administered through both public and private sector insurance companies, in tie up with scheduled commercial banks, regional rural banks and cooperative banks.

- PMJJBY offers a renewable one year term life cover of Rupees Two Lakh to all subscribing bank account holders in the age group of 18 to 50 years, covering death due to any reason, for a premium of Rs.330/- per annum per subscriber, to be auto debited from subscriber’s bank account.

- PMSBY offers a renewable one year accidental death cum disability cover to all subscribing bank account holders in the age group of 18 to 70 years for a premium of Rs.12/-per annum per subscriber to be auto debited from subscriber’s bank account. The scheme provides a cover of Rs. Two Lakh for accidental death or total permanent disability and Rs One Lakh in case of permanent partial disability.

- The above schemes are on self-subscription basis and involves no Government contribution.

Pradhan Mantri Vaya Vandana Yojana’(PMVVY)

- Insurance is to protect elderly persons aged 60 years and above against a future fall in their interest income due to the uncertain market conditions, as also to provide social security during old age.

- The scheme provides an assured return of 8% per annum for 10 years.

- The differential return i.e. the difference between return generated by LIC and the assured return of 8% per annum is borne by Government of India as subsidy on annual basis

- Mode of pension payment is monthly, quarterly, half-yearly and annually based on option exercised by the subscriber.

- The scheme was open initially for subscription for a period of one year i.e. from 4th May, 2017 to 3rd May, 2018. In pursuance to Budget Announcement 2018-19, the scheme has been extended up to 31st March, 2020.

- The minimum purchase price under the scheme is Rs.1.5 lakh per family for a minimum pension of Rs. 1,000/- per month and the maximum purchase price has been enhanced from Rs.7.5 lakh per family to Rs 15 lakh per senior citizen for a maximum pension of Rs.10,000/- per month.

Pradhan Mantri Fasal Bima Yojana (PMFBY) and Restructured Weather Based Crop Insurance Scheme (RWBCIS)

- Provide comprehensive crop insurance cover against non-preventable natural risks at an affordable rate to farmers.

- The scheme is compulsory for loanee farmers and voluntary for non-loanee farmers for notified crops in notified areas.

- Uniform maximum premium of only 2%, 1.5% and 5% of the sum insured to be paid by farmers for all Kharif crops, Rabi crops and commercial/horticultural crops respectively.

- The difference between premium and the rate of insurance charges payable by farmers is provided as subsidy and shared equally by the Centre and State.

Pradhan Mantri Jan Arogya Yojana / Ayushman Bharat

- Pradhan Mantri Jan Arogya Yojana (PMJAY) a centrally sponsored scheme.

- PMJAY provides health coverage upto Rs. 5 lakh per family, per year for secondary and tertiary hospitalization to over 10.74 crore poor and vulnerable families (approximately 50 crore beneficiaries).

- PMJAY is an entitlement based scheme.

- This scheme covers poor and vulnerable families based on deprivation and occupational criteria as per SECC data.

- PMJAY provides cashless and paperless access to services for the beneficiary at the point of service in any (both public and private) empaneled hospitals across India.

- There is no restriction on family size, ensuring all members of designated families specifically girl child and senior citizens get coverage.About 1393 packages are available for the beneficiaries under PMJAY.

- The ratio of premium under PMJAY is 60:40 between Centre and State except North Eastern States and 3 Himalayan States where the ratio is 90:10 with an upper limit for Centre

Government initiatives for resolving NPA issue

Recognising NPAs transparently

- Forbearance has been ended and stressed assetsclassified as NPAs under the Asset Quality Review (AQR) in 2015 and subsequent recognition by banks.

- Further, restructuring schemes that permitted such forbearance have been discontinued in February 2018.

- As a result, as per RBI data, Standard Restructured Assets (SRAs) of Scheduled Commercial Banks (SCBs) have declined from the peak of 6.5% in March 2015 to

- 0.49% in September 2018.

Resolving and recovering value from stressed accounts through clean and effective laws and processes:

- A fundamental change has been effected in the creditor-debtor relationship through the Insolvency and Bankruptcy Code, 2016 (IBC) and debarment of wilful defaulters and connected persons from the resolution process.

- To make other recovery mechanisms as well more effective, Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI)Act has been amended to provide for three months imprisonment in case borrower does not provide asset details, and for lender getting possession of mortgaged property within 30 days, and six new Debts Recovery Tribunal (DRTs) have been established.

Reforming banks through the PSB Reforms Agenda

- Number of lenders in consortium restricted by requiring minimum of 10%, for better managed consortium lending,

- Ring-fencing of cash flows for prudent lending,

- Monitoring of loans above Rs. 250 crore through specialised agencies for effective vigil,

- Use of technology and analytics for comprehensive due- diligence across data sources,

- Comprehensive checking of all accounts of Rs. 50 crore and above that turn NPA for wilful default and fraud,

- Strict enforcement of conditions of loan sanction,

- Establishment of Stressed Asset Management Verticals in banks for focussed recovery and timely and effective management of stressed accounts,

- Collection of passport details of borrowers for loans above Rs. 50 crore, and

- Enactment of the Fugitive Economic Offenders Act, 2018 in order to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts.

Measures taken to control and prevent frauds in banks

- Government has issued “Framework for timely detection, reporting, investigation etc. relating to large value bank frauds” to Public Sector Banks (PSBs), which provides, inter-alia, that

- All accounts exceeding Rs. 50 crore, if classified as Non-Performing Assets be examined by banks from the angle of possible fraud, and a report placed before the bank’s Committee for Review of NPAs on the findings of this investigation;

- Examination be initiated for wilful default immediately upon reporting fraud to RBI; and

- Report on the borrower be sought from the Central Economic Intelligence Bureau in case an account turns NPA.

- Fugitive Economic Offenders Act, 2018 has been enacted to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts. It provides for attachment of property of a fugitive economic offender, confiscation of such offender’s property and disentitlement of the offender from defending any civil claim.

- Central Fraud Registry (CFR), based on Fraud Monitoring Returns filed by banks and select financial institutions, has been set up by RBI as a searchable online central database for use by banks.

- For enforcement of auditing standards and ensuring the quality of audits Government has initiated establishment of National Financial Reporting Authority as an independent regulator.

PSBs have been instructed to—

- ensure implementation, within stipulated deadlines, measures prescribed by RBI for strengthening the SWIFT operating environment in banks,

- decide on publishing photographs of wilful defaulters, in terms of RBI’s instructions and as per their Board-approved policy,

- meticulously follow RBI’s framework for dealing with loan frauds and Red Flagged Accounts,

- implement RBI guidelines to prevent skimming of ATM/debit/credit cards, and

- ensure legal audit of title documents in respect of large value loan accounts,

- obtain certified copy of the passport of the promoters/directors and other authorised signatories of companies availing loan facilities of more than Rs. 50 crore,

- strictly ensure rotational transfer of officials/employees.

One Stop Centres

- The Ministry of women and child development is implementing scheme for setting up of One Stop Centres since 1st April, 2015 to support women affected by violence.

- The scheme aims to facilitate access to an integrated range of services including medical aid, police assistance, legal aid/case management, psycho-social counselling, temporary support services to women affected by violence.

- Under the scheme, it has been envisaged that One Stop Centres would be set up across the country in phased manner.

6 . Year End Review

- Ministry of Social Justice and Empowerment

- Ministry of Minority Affairs

- Ministry of Home (not very important)

- Ministry of Consumer Affairs, Food and Public Distribution