Daily Current Affairs for UPSC CSE

Topics Covered

- Global Hunger Index

- Medical Termination of Pregnancy (Amendment) Act

- Money Bill

- Caste Census

- (CAR-T cell) therapy

- Semiconductor

- Facts for Prelims

1 . Global Hunger Index

Context: India ranks 111 out of a total of 125 countries in the Global Hunger Index (GHI) 2023, with its progress against hunger nearly halted since 2015, reflecting a global trend.

About Global Hunger Index

- The Global Hunger Index (GHI) is a tool that attempts to measure and track hunger globally as well as by region and by country.

- It is prepared by European NGOs : Concern Worldwide and Welthungerhilfe.

- Countries are divided into five categories of hunger on the basis of their score, which are ‘low’, ‘moderate’, ‘serious’, ‘alarming’ and ‘extremely alarming’.

- According to the methodology, a score less than 9.9 is considered ‘low’, 10-19.9 is ‘moderate’, 20-34.9 is ‘serious’, 35-49.9 is ‘alarming’, and above 50 is ‘extremely alarming’.

- Based on the values of the four indicators, a GHI score is calculated on a 100-point scale reflecting the severity of hunger, where zero is the best score (no hunger) and 100 is the worst.

Parameters for measurement

- Each country’s GHI score is calculated based on a formula that combines four indicators that together capture the multidimensional nature of hunger:

- Undernourishment: The share of the population whose caloric intake is insufficient;

- Child stunting: The share of children under the age of five who have low height for their age, reflecting chronic undernutrition;

- Child wasting: The share of children under the age of five who have low weight for their height, reflecting acute undernutrition; and

- Child mortality: The share of children who die before their fifth birthday, reflecting in part the fatal mix of inadequate nutrition and unhealthy environments.

Performance of India

- India ranks 111 out of a total of 125 countries in the Global Hunger Index (GHI) 2023.

- It has a Global Hunger Index score of 28.7 on a 100-point scale.

- The severity of hunger is categorised as “serious”

- While it made significant strides between 2000 and 2015, with its score improving from 38.4 in 2000 to 35.5 in 2008 and 29.2 in 2015, over the past eight years, It has advanced on the GHI by only 0.5 points.

Global Performance

- South Asia and Africa South of the Sahara are the world regions with the highest hunger levels, with GHI scores of 27.0 each, indicating serious hunger. West Asia and North Africa is the region with the third-highest hunger level with a score of 11.9 indicating “moderate” hunger level.

- Latin American and the Caribbean is the only region in the world whose GHI scores have worsened between 2015 and 2023.

- East and Southeast Asia, dominated by populous China, has the second-lowest 2023 GHI score of any region in the report. China, for example, is among the top 20 countries that each have a GHI score of less than 5.

- The region with the lowest 2023 GHI score is Europe and Central Asia, whose score of 6.0 is considered “low”.

Issues raised by the government

- The Ministry of Women and Child Development (MoWCD) questioned the GHI and called it a flawed measure of hunger that doesn’t reflect India’s true position.

- It said that data recorded on its Poshan Tracker portal showed child wasting prevalence of 7.2% among a total of 7.24 crore under-five-year-olds whose data was captured, whereas the GHI used a value of 18.7% for child wasting. The latter, however, comes from the National Family Health Survey 5 (NFHS) 2019-2021, which is reported in the global repository, Joint Malnutrition Estimates Joint Data Set Including Survey Estimates, set up to ensure harmonised child nutrition estimates.

- The second objection reiterated by the Ministry was the alleged use of a telephone-based opinion poll to calculate undernourishment, one of the indicators used in GHI. The GHI has maintained that it doesn’t use the poll, but relies on data from India’s Food Balance Sheet to calculate undernourishment.

2 . Medical Termination of Pregnancy (Amendment) Act

Context: A Division Bench of two women judges of the Supreme Court on Wednesday were split in their opinions about the decision of a married woman to abort her 26-week pregnancy and the Centre’s resolve to save the “unborn child”.

Details of the case

- The case involves A married woman who wanted to abort her 26-weeks pregnancy. She informed the Bench that she was taking medication for her mental condition and was not in a position to take care of a third child.

- the Bench of Justices Kohli and Nagarathna had, after getting a report from an All India Institute of Medical Sciences medical board, allowed the medical termination of the woman’s pregnancy in accordance with her wish.

- However, the Union returned to the Supreme Court with an application which said that one of the expert doctors on the medical board had emailed the Additional Solicitor General against the abortion, saying the child should be given a chance to survive and the state has a responsibility towards the unborn.

- Additional Solicitor General for the Union government claimed that the woman has no absolute right of autonomy to exercise her reproductive rights in a way that would take away the rights of her unborn child.

- She further referred to the Medical Termination of Pregnancy (Amendment) Act of 2021, which extended the deadline for abortion in “exceptional circumstances” to 24 weeks. She said these circumstances allowed medical termination only if it was necessary to save the life of the mother or in case of a fatal deformity detected in the foetus.

- Justice Kohli, in her opinion, agreed with the government that the woman should not be permitted to terminate the pregnancy.

- However, Justice Nagarathna disagreed with her colleague on the Bench, saying the woman’s decision ought to be respected.

Indian Abortion Laws

How did abortion laws come about in India?

- In the 1960s, due to a high number of induced abortions taking place, the Union government constituted Shantilal Shah Committee to deliberate on the legalisation of abortion in the country.

- To reduce maternal mortality owing to unsafe abortions, the Medical Termination of Pregnancy (MTP) Act was brought into force in 1971.

- This law is an exception to the Indian Penal Code (IPC) provisions of 312 and 313 and sets out the rules of how and when a medical abortion can be carried out.

- Section 312 of the Indian Penal Code, 1860: It criminalises voluntarily “causing miscarriage” even when the miscarriage is with the pregnant woman’s consent, except when the miscarriage is caused to save the woman’s life.

MTP Act, 1971

- In 1971, The Medical Termination of Pregnancy Act (MTP Act) was introduced to “liberalise” access to abortion since the restrictive criminal provision was leading to women using unsafe and dangerous methods for termination of pregnancy.

- It allowed termination of pregnancy by a medical practitioner in two stages.

- For termination of pregnancy up to 12 weeks: opinion of one doctor was required.

- For pregnancies between 12 and 20 weeks: opinion of two doctors was required.

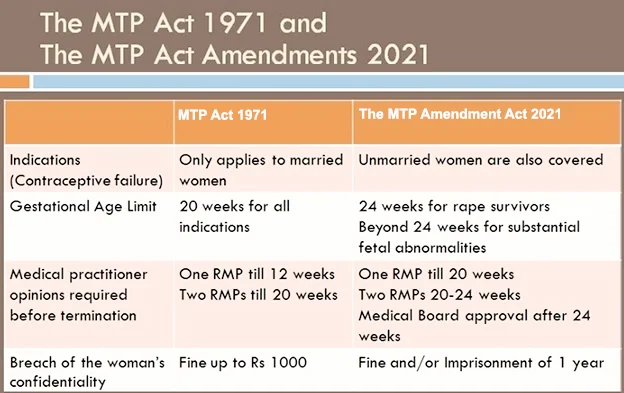

Medical Termination of Pregnancy (MTP) Amendment Act

- The MTP Act regulates the conditions under which a pregnancy may be aborted. The amendment increases the time period within which abortion may be carried out.

- Before the amendment, abortion requires the opinion of one doctor if it is done within 12 weeks of conception and two doctors if it is done between 12 and 20 weeks. The amendment allows abortion to be done on the advice of one doctor up to 20 weeks, and two doctors in the case of certain categories of women between 20 and 24 weeks.

- Upper gestation limit to not apply in cases of substantial foetal abnormalities diagnosed by a Medical Board.

- The amendment sets up state level Medical Boards to decide if a pregnancy may be terminated after 24 weeks in cases of substantial foetal abnormalities.

Key Features of Medical Termination of Pregnancy (MTP) Amendment

The Bill amends the Medical Termination of Pregnancy Act, 1971.

- Time limit and grounds for terminating a pregnancy: The 1971 Act specifies the grounds for terminating a pregnancy and specifies the time limit for terminating a pregnancy. The amendment amends these provisions.

| Time since conception | Requirement for terminating pregnancy | |

| MTP Act , 1971 | MTP Amendment | |

| Up to 12 weeks | Advice of one doctor | Advice of one doctor |

| 12 to 20 weeks | Advice of two doctors | Advice of one doctor |

| 20 to 24 weeks | Not allowed | Two doctors for some categories of pregnant women |

| More than 24 weeks | Not allowed | Medical Board in case of substantial foetal abnormality |

| Any time during the pregnancy | One doctor, if immediately necessary to save pregnant woman’s life |

- Termination due to failure of contraceptive method or device: Under the original Act a pregnancy may be terminated up to 20 weeks by a married woman in the case of failure of contraceptive method or device. The amendment allows unmarried women to also terminate a pregnancy for this reason.

- Medical Boards: All state and union territory governments will constitute a Medical Board. The Board will decide if a pregnancy may be terminated after 24 weeks due to substantial foetal abnormalities. Each Board will have a gynaecologist, paediatrician, radiologist/sonologist, and other members notified by the state government.

- Privacy: A registered medical practitioner may only reveal the details of a woman whose pregnancy has been terminated to a person authorised by law. Violation is punishable with imprisonment up to a year, a fine, or both.

Criticisms against the abortion law

- The MTP Act requires abortion to be performed only by doctors with specialization in gynecology or obstetrics. However, the Ministry of Health and Family Welfare’s 2019-20 report on Rural Health Statistics indicates that there is a 70% shortage of obstetrician-gynecologists in rural India.

- Law does not permit abortion at will; it pushes women to access illicit abortions under unsafe conditions.

- Statistics put the annual number of unsafe and illegal abortions performed in India at 8,00,000, many of them resulting in maternal mortality.

- The MTP Amendment Act perpetuates the lack of rights-based framing from the original Act. Instead of being grounded in rights, it merely grants exemption from criminal liability.

- Current law protects access to abortion only for pregnant women and does not recognize the diverse experiences of all persons including transgender and nonbinary people.

- The addition of third-party authorizations like that of Medical Boards could act as a significant barrier to accessing safe abortion, especially for pregnant women and girls living in rural and tribal areas, and those coming from marginalized socio-economic backgrounds.

- The shortfall of qualified medical practitioners within the public health system: which is often the only accessible healthcare system in least-served areas. Even where it is accessible, the additional authorization requirement is likely to cause delays in receiving urgent abortion care.

3 . Money Bill

Context: A seven-judge Bench of the Supreme Court headed by Chief Justice of India D.Y. Chandrachud said it will “take a call” on a request from petitioners to give priority to a reference concerning the manner in which the Centre got crucial amendments passed in Parliament as Money Bills.

Background of the case:

- The seven-judge Bench is hearing the Money Bill question based on a reference made by a five-judge Bench headed by then Chief Justice Ranjan Gogoi in the case of Rojer Mathew vs. South Indian Bank Ltd. The cardinal issue is whether such amendments could be passed as a Money Bill, circumventing the Rajya Sabha, in violation of Article 110 of the Constitution.

- The reference includes legal questions concerning amendments made from 2015 onwards in the Prevention of Money Laundering Act (PMLA) through Money Bills, giving the Enforcement Directorate almost blanket powers of arrest, searches. Though the court had upheld the legality of the PMLA amendments, it left the question whether the amendments could have been passed as Money Bills to the seven-judge Bench.

- The case also raises questions about the passage of the Finance Act of 2017 as a Money Bill to alter the appointments to 19 key judicial tribunals, including the National Green Tribunal and the Central Administrative Tribunal.

- Petitioner argued that the 2017 Act was deliberately categorised as a Money Bill to extend executive control over tribunals by altering the composition of the selection committees and vastly downgrading the qualifications and experience required to staff these bodies.

What is a Money Bill?

- Article 110 of the Indian Constitution defines what constitutes a “money bill” in India and outlines the specific procedures for the passing of money bills in the Indian Parliament.

- They are concerned with financial matters like taxation, public expenditure, etc.

What constitutes a money bill?

- The imposition, abolition, remission, alteration or regulation of any tax.

- The regulation of the borrowing of money by the Union government.

- The custody of the Consolidated Fund Of India or the contingency fund of India, the payment of money into or the withdrawal of money from any such fund.

- The appropriation of money out of the Consolidated Fund of India.

- Declaration of any expenditure charged on the Consolidated Fund of India or increasing the amount of any such expenditure.

- The receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money, or the audit of the accounts of the Union or of a state.

How are they passed?

- A money bill can originate only in the Lok Sabha.

- After being passed by the Lok Sabha, Money Bills are sent to the Rajya Sabha for its recommendations.

- Within 14 days, the Upper House must submit the Bill back to the Lower House with its non-binding recommendations.

- If the Lok Sabha rejects the recommendations, the Bill is deemed to have passed by both Houses in the form in which it was passed by the Lok Sabha without the recommendations of the Rajya Sabha.

- Even if the Rajya Sabha doesn’t respond with its recommendations within 14 days, the same consequences would follow. Thus, when it comes to Money Bills, the Rajya Sabha only has a recommendatory role.

Advantages of Moneybill over Financial Bill

- The procedure of introduction and passage of a Money Bill. Under Article 109 (1), such a Bill can be introduced only in Lok Sabha.

- Once passed by Lok Sabha, it goes to Rajya Sabha — along with the Speaker’s certificate that it is a Money Bill — for its recommendations. However, Rajya Sabha can neither reject nor amend it, and must return it within 14 days, after which Lok Sabha may accept or reject all or any of its recommendations. In either case, the Bill is deemed to have been passed by both Houses.

- Under Article 109 (5), if Rajya Sabha fails to return the Bill to Lok Sabha within 14 days, it is deemed to have been passed anyway.

- Non-Money Bills cannot become law unless agreed to by both Houses, and in case of a deadlock (if, for example, Rajya Sabha continues to block legislation indefinitely), the way out is a joint sitting of both Houses (Article 108). This question does not arise in the case of a Money Bill, since it does not go to a joint sitting, and Lok Sabha can override the wish of Rajya Sabha.

Finance Bill and Money Bill

- A Finance Bill is a Money Bill but not all money bills are Finance Bills. Under Article 110(1) of the Constitution a money bill is defined as follows…

- 110(1) a Bill is deemed to be a Money Bill if it contains only provisions dealing with all or any of the following matters, namely:

- the imposition, abolition, remission, alteration or regulation of any tax;

- the regulation of the borrowing of money or the giving of any guarantee by the Government of India, or the amendment of the law with respect to any financial obligations undertaken or to be undertaken by the Government of India;

- the custody of the Consolidated Fund or the Contingency Fund of India, the payment of moneys into or the withdrawal of moneys from any such fund;

- the appropriation of moneys out of the Consolidated Fund of India;

- the declaring of any expenditure to be expenditure charged on the Consolidated Fund of India or the increasing of the amount of any such expenditure;

- the receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money or the audit of the accounts of the Union or of a State; or

- any matter incidental to any of the matters specified in sub-clauses (a) to (f).

- 110 (2.) A Bill is not deemed to be Money Bill by reason only that it provides for the imposition of fines or other pecuniary penalties, or for the demand or payment of fees for licences or fees for services rendered, or by reason that it provides for the imposition, abolition, remission, alteration or regulation of any tax by any local authority or body for local purposes….

- Finance Bill is generally limited to Article 110(1)(a) & (g) – the imposition, abolition, remission, alteration or regulation of any tax and any matter incidental thereto.

4 . Caste Census

Context: After the publication of a caste survey in Bihar, which found that 63% of Bihar’s 13 crore population belong to castes listed under the Extremely Backward Classes (EBC) and Other Backward Classes (OBC) categories, Prime Minister Narendra Modi criticised and rejected the demand for a nationwide caste census made by Congress and several other Opposition parties.

What is a Caste Census?

- A caste census, also known as a caste-based census, is a population enumeration process in which individuals are categorized and counted according to their caste or social group.

- This type of census seeks to collect data on the social and economic characteristics of different caste groups within a particular population.

When did caste census begin?

- Caste wise enumeration of the population was introduced under the British colonial administration in 1881 and continued till the 1931 census.

- Independent India’s governments abandoned full caste enumeration on the apprehension that it would strengthen caste divisions and perpetuate the caste system.

- Socio-economic caste census was first conducted in 1931 which aimed to collect information on the economic status of Indian families, both in rural and urban areas, to identify indicators of deprivation.

- It also collects data on specific caste names to evaluate the economic conditionsof different caste groups.

- The Mandal Commission report had extrapolated from the caste/community-wise population figures of the 1931 census and estimated the combined population of Hindu and non-Hindu OBCs to be 52% of India’s population. The commission had also arrived upon a crucial conclusion, that “caste is also a class of citizens and if the caste as a whole is socially and educationally backward, reservation can be made in favour of such a caste on the ground that it is a socially and educationally backward class of citizens within the meaning of Article 15(4).”

What do socio-economic data indicate?

- The intersection between class and caste-based deprivation in Indian society is evident in a gamut of socio-economic statistics. The average monthly per capita consumption expenditures (MPCE) of Scheduled Tribes (ST), Scheduled Castes (SC) and OBC households in rural areas were, respectively 65%, 73% and 84% of the MPCE of the ‘Others’, i.e. the general category, as per the National Sample Survey (NSS), 2011-12. In urban areas the average MPCE of ST, SC and OBC households were 68%, 63% and 70% of the general category in 2011-12.

- The persistence of inequality across caste categories in India can also be seen in the multidimensional poverty estimates based on the National Family Health Survey (NFHS-4/2015-16).

- Disproportionate concentration of poverty among the STs, SCs, OBCs and Muslims in India have remained stable over time. This clearly indicate that discrimination and exclusion based on caste via-a-vis STs, SCs and OBCs as well as religion, particularly with regard to Muslims, have a causal relationship with poverty and deprivation.

What did Indra Sawhney judgement ensure?

- While the population share of OBCs was estimated at 52%, only 27% reservation for OBCs in all government services, technical and professional institutions was recommended by the Mandal commission, in order to keep the overall reservation for SCs, STs and OBCs together below the 50% ceiling set by the Supreme Court.

- The V.P. Singh government implemented 27% OBC reservation for public services in 1990 and following legal challenges, the Supreme Court upheld it in the Indra Sawhney & others versus Union of India judgment in 1992 with the significant observation: “Identification of a group or collectivity by any criteria other than caste, such as, occupation cum social cum educational cum economic criteria ending in caste may not be invalid.” This cleared the way for OBC reservation in public employment and educational institutions in India.

- The demand to resuscitate full caste enumeration in the national census has arisen as a corollary of these historical developments. Numerous government policies, including reservations and other benefit schemes are currently implemented on the basis of the claimed population share of caste groups, even though the actual population size of caste groups in the OBC and general category remain unknown.

Benefits

- Targeted Policy Formulation: Caste-based data can help policymakers identify and understand the unique challenges faced by different caste groups, enabling them to create more targeted and effective policies and programs. This can be particularly valuable in addressing social and economic inequalities.

- Social Justice: It can aid in the identification and rectification of historical injustices and discriminations faced by marginalized caste groups. Data can serve as a basis for affirmative action policies, reservations, and social welfare programs.

- Research and Analysis: Researchers and scholars can use caste data to conduct in-depth studies on various aspects of Indian society, including social mobility, economic disparities, and education. This research can inform evidence-based policies.

Issues

- Trigger demands: Opposition to a nationwide caste census has been aired from some quarters on the ground that the revelation of the exact population share of OBCs greater than or equal to 52%, as estimated by the Mandal commission, would trigger demands for enhancing the 27% reservation quota for OBCs.

- Reinforcing Caste identities: It will further reinforce the caste identities in India.

- Political Sensitivity: Caste is a highly politicized issue in India. The census could lead to heightened political tensions, especially if certain groups feel that their interests are not being represented fairly.

- Stigmatization: In some cases, individuals may be stigmatized based on their caste. Collecting caste data could inadvertently reinforce such stigmatization.

5 . CAR-T cell therapy

Context: IIT Bombay-incubated Immunoadoptive Cell Therapy (ImmunoACT), in which drugmaker Laurus Labs holds about 34% stake, has received Central Drugs Standard Control Organisation’s (CDSCO) marketing authorisation approval of the ‘first’ humanised CD19-targeted Chimeric Antigen Receptor T cell (CAR-T cell) therapy product for relapsed/refractory B-cell lymphomas and leukaemia (blood cancer) in India.

What is CAR-T cell therapy ?

- CAR T cell therapy is a type of cancer immunotherapy treatment that uses immune cells called T cells that are genetically altered in a lab to enable them in locating in destroying cancer cells more effectively.

How does it work?

- T-Cell Collection: The process begins with the collection of the patient’s T cells, which are a type of immune cell. This is typically done through a process called leukapheresis, where blood is drawn from the patient, and the T cells are separated from the rest of the blood components.

- CAR T-Cell Engineering: In a laboratory, the patient’s T cells are genetically modified to express a Chimeric Antigen Receptor (CAR) on their surface. The CAR is a synthetic receptor that combines an antigen-binding domain with signaling domains from the T-cell receptor and co-stimulatory molecules.

- CAR T-Cell Expansion: The engineered CAR T cells are then cultured and expanded in the lab to generate a large population of these modified T cells.

- Patient Preconditioning: Before CAR T-cell infusion, the patient may undergo a brief conditioning regimen, which can include chemotherapy to reduce the number of existing immune cells. This creates space for the infused CAR T cells to proliferate and act.

- CAR T-Cell Infusion: The modified and expanded CAR T cells are then infused back into the patient’s bloodstream. This infusion is a one-time procedure.

- Recognition of Cancer Cells: The CAR on the surface of CAR T cells is designed to recognize specific antigens found on the surface of cancer cells. When CAR T cells encounter cancer cells with the matching antigen, they bind to the cancer cells.

- Activation and Killing: Once bound to the cancer cell, the CAR T cells become activated and launch a powerful immune response. They release cytotoxic substances, such as perforin and granzyme, and destroy the cancer cells. CAR T cells can also stimulate an immune response by recruiting other immune cells to attack the cancer.

Significance

- CAR T-cell therapy has shown remarkable success in the treatment of certain blood cancers, particularly B-cell malignancies like acute lymphoblastic leukemia (ALL) and non-Hodgkin lymphoma.

- One of the major advantages of CAR T-cell therapy is the short treatment time needed – administered with a single infusion that may require at the most, two weeks of inpatient care.

- It is also a “living drug” as its benefits can last for many years. Since the cells can persist in the body long-term, they may recognize and attack cancer cells if and when there’s a relapse.

Challenges

- Like life-threatening CAR T-cell associated toxicities (cytokine release syndrome, neurologic toxicities, prolonged cytopenias, etc.), inhibition and resistance in B-cell malignancies, antigen escape, limited efficacy against solid tumors, and the spector of secondary malignancies.

- One of the most challenging limitations is accessibility, since only 20% of the patients for which CAR T-cells therapy is indicated have access to the treatment.

6 . Semiconductors

Context: Six working groups, which had been formed to mull the Indian government’s artificial intelligence (AI) roadmap, have submitted the first edition of their report, Minister of State for Electronics and Information Technology Rajeev Chandrasekhar said.

What are semi- conductors?

- Semiconductors are materials that have a conductivity between conductors (generally metals) and non- conductors or insulators (such as most ceramics). Semiconductors can be pure elements, such as silicon or germanium, or compounds such as gallium arsenide or cadmium selenide.

Properties of Semiconductors

- Semiconductors possess specific electrical properties. A substance that conducts electricity is called a conductor, and a substance that does not conduct electricity is called an insulator. Semiconductors are substances with properties somewhere between them.

- Property 1: The resistivity of a semiconductor is not greater than that of an insulator but greater than that of a conductor.

- Property 2: Semiconductors exhibit negative resistance values. …

- Property 3: At zero kelvin, semiconductors act as insulators.

Main types of semiconductors

The two main types of semiconductors are n-type and p-type.

- An n-type semiconductor contains one or more impurities based on pentavalent atoms like phosphorus, arsenic, antimony, and bismuth

- A p-type semiconductor has dopants with five electrons in its valence layer. Phosphorus is commonly used for this purpose, as well as arsenic, or antimony.

Applications of Semi-Conductors

- Semiconductors are used in the manufacture of various types of electronic devices, including diodes, transistors, and integrated circuits.

- Semiconductors are used in almost every field of electronics. Consumer electronics: Cell phones, laptops, games consoles, microwaves and refrigerators all work with the use of semiconductor devices such as integrated chips, diodes and transistors.

What is a semiconductor chip?

- A semiconductor chip is composed of transistors, which in turn are meticulously crafted from a specially selected material, typically silicon.

- One major function of a transistor is to encode information in the form of 0s and 1s, and to manipulate them to produce new information.

- These transistors have three parts: the source, the gate, and the drain (or the sink).

- How it works? – The flow of current between the source and the drain points is regulated by the voltage applied to the gate. This arrangement gave rise to the specific meaning of ‘gate’ in computing – analogous to a physical gate but operating with electrical means rather than mechanical ones.

- By manipulating the gate to ‘open’ or ‘close’, the transistor stores and manipulates the data in a semiconductor chip. The semiconductor stores information in the form of bits. Each bit is a logical state that can have one of two values (represented by voltage levels) at a time. The more bits a semiconductor can store and the more quickly it can manipulate them, the more data transistors can process.

- The three parts of a transistor are connected to multiple metal layers on top of them that apply voltages, forming a complex mesh of electrical connections with the transistors. The metal layers allow selective access to a transistor and provide the versatility required for the chip to execute multiple tasks.

Significance of Semiconductors for India

- Economic Growth: According to experts, semiconductors are at the core of contemporary economics. In today’s technological world, where nearly everything revolves all over electronic devices, the relevance of microchips cannot be overstated.

- Digital devices: There would be no smartphones, radios, televisions, laptops, computer systems, or even advanced medical devices without semiconductor chips as they are used in the production of electronic devices. In addition, with the advent of e-vehicles, The demand for semiconductors is anticipated to skyrocket.

- Limited Supply: These chips are made in only a few nations worldwide. The U.S, Taiwan, South Korea, Japan, and the Netherlands dominate the industry.

Challenges in semiconductors manufacturing for India:

- Lack of Infrastructure: Building and maintaining semiconductor manufacturing facilities (fabs) require a massive investment in infrastructure, such as specialized equipment, and reliable power and water supply. India needs to invest significantly in such infrastructure.

- High Capital Investment: Semiconductor manufacturing is capital-intensive, requiring substantial investments in research and development, equipment, and technology. Attracting investment for semiconductor fabs is a major challenge.

- Skilled Workforce: The semiconductor industry demands a highly skilled workforce, including engineers, scientists, and technicians. India must address the shortage of skilled talent in areas such as chip design, process technology, and equipment maintenance.

- Technology and IP Challenges: Developing cutting-edge semiconductor technologies and intellectual property (IP) is a challenge. Many advanced technologies are held by a handful of global giants. India needs to invest in R&D and innovation to catch up.

- Global Competition: India faces intense global competition from countries with well-established semiconductor industries, such as Taiwan, South Korea, and the United States. Competing with established players requires strategic planning and incentives.

- Regulatory and Taxation Issues: India’s regulatory environment and taxation policies can pose challenges for semiconductor manufacturing. Streamlining regulations and offering incentives to manufacturers is essential.

India Semiconductor Mission

- India Semiconductor Mission (ISM) has been setup as an Independent Business Division within Digital India Corporation.

- ISM has all the administrative and financial powers and is tasked with the responsibility of catalysing the India Semiconductor ecosystem in manufacturing, packaging and design. ISM has an advisory board consisting of some of the leading global experts in the field of semiconductors.

- ISM is serving as the nodal agency for efficient, coherent and smooth implementation of the programme for development of semiconductor and manufacturing ecosystem in India.

Objectives of ISM are as under:

- Formulate a comprehensive long-term strategy for developing sustainable semiconductors and display manufacturing facilities and semiconductor design eco-system in the country in consultation with the Government ministries / departments / agencies, industry, and academia.

- Facilitate the adoption of secure microelectronics and developing trusted semiconductor supply chain, including raw materials, specialty chemicals, gases, and manufacturing equipment.

- Enable a multi-fold growth of Indian semiconductor design industry by providing requisite support in the form of Electronic Design Automation (EDA) tools, foundry services and other suitable mechanisms for early-stage startups.

- Promote and facilitate indigenous Intellectual Property (IP) generation.

- Encourage, enable and incentivize Transfer of Technologies (ToT).

- Establish suitable mechanisms to harness economies of scale in Indian semiconductor and display industry.

- Enable cutting-edge research in semiconductors and display industry including evolutionary and revolutionary technologies through grants, global collaborations and other mechanisms in academia / research institutions, industry, and through establishing Centres of Excellence (CoEs).

- Enable collaborations and partnership programs with national and international agencies, industries and institutions for catalyzing collaborative research, commercialization and skill development.

Semicon India Programme

- Government has approved the Semicon India programme with a total outlay of INR 76,000 crore for the development of semiconductor and display manufacturing ecosystem in the country.

- The programme has further been modified in view of the aggressive incentives offered by countries already having established semiconductor ecosystem and limited number of companies owning the advanced node technologies.

- The modified programme aims to provide financial support to companies investing in semiconductors, display manufacturing and design ecosystem. This will serve to pave the way for India’s growing presence in the global electronics value chains.

Following four schemes have been introduced under the aforesaid programme:

- ‘Modified Scheme for setting up of Semiconductor Fabs in India’ for attracting large investments for setting up semiconductor wafer fabrication facilities in the country to strengthen the electronics manufacturing ecosystem and help establish a trusted value chain. The Scheme extends a fiscal support of 50% of the project cost on pari-passu basis for setting up of Silicon CMOS based Semiconductor Fab in India.

- ‘Modified Scheme for setting up of Display Fabs in India’ for attracting large investments for manufacturing TFT LCD or AMOLED based display panels in the country to strengthen the electronics manufacturing ecosystem. Scheme extends fiscal support of 50% of Project Cost on pari-passu basis for setting up of Display Fabs in India.

- ‘Modified Scheme for setting up of Compound Semiconductors / Silicon Photonics / Sensors Fab / Discrete Semiconductors Fab and Semiconductor Assembly, Testing, Marking and Packaging (ATMP) / OSAT facilities in India’ shall extends a fiscal support of 50% of the Capital Expenditure on Pari-passu basis for setting up of Compound Semiconductors / Silicon Photonics (SiPh) / Sensors (including MEMS) Fab/ Discrete Semiconductor Fab and Semiconductor ATMP / OSAT facilities in India.

- ‘Semicon India Future Design: Design Linked Incentive (DLI) Scheme’ offers financial incentives, design infrastructure support across various stages of development and deployment of semiconductor design for Integrated Circuits (ICs), Chipsets, System on Chips (SoCs), Systems & IP Cores and semiconductor linked design. The scheme provides “Product Design Linked Incentive” of up to 50% of the eligible expenditure subject to a ceiling of ₹15 Crore per application and “Deployment Linked Incentive” of 6% to 4% of net sales turnover over 5 years subject to a ceiling of ₹30 Crore per application.

7 . Facts for Prelims

Hydrogen Sulphide

- Hydrogen sulfide is a chemical compound with the formula H2S.

- It is a colorless chalcogen-hydride gas, and is poisonous, corrosive, and flammable, with trace amounts in ambient atmosphere having a characteristic foul odor of rotten eggs.

- Hydrogen sulfide is toxic to humans and most other animals by inhibiting cellular respiration in a manner similar to hydrogen cyanide

- Hydrogen sulfide is often produced from the microbial breakdown of organic matter in the absence of oxygen, such as in swamps and sewers.

- It also occurs in volcanic gases, natural gas deposits, and sometimes in well-drawn water.

NSG

- The National Security Guard (NSG), commonly known as Black Cats, is a counter-terrorism unit of India under the Ministry of Home Affairs.

- It was founded on 1984, following Operation Blue Star, for combating terrorist activities and protect states against internal disturbances.

- It is one of the seven Central Armed Police Forces of India.

Committee for the purpose of Control and Supervision of Experiments on Animals (CCSEA)

- The Committee for the Purpose of Control and Supervision of Experiments on Animals (CPCSEA) is a statutory body formed by the Act of the Indian Parliament under the Prevention of Cruelty to Animals Act 1960.

- The committee is composed of members of the scientific community, regulatory authorities and animal activists.