Daily Current Affairs for UPSC CSE

Topics Covered

- Supreme Court Verdict on sub-classification of Scheduled Castes and Scheduled Tribes

- Draft rules on the implementation of in-flight WiFi connectivity

- Impact of Lock down on Women entrepreneurs

- GST Compensation

- Great Andaman Tribe

- Wolbachia Bacteria

- Facts for Prelims

1 . Supreme Court Verdict on sub-classification of Scheduled Castes and Scheduled Tribes

Context: A five-judge Constitution Bench of the Supreme Court is reconsidering the sub-categorisation of Scheduled Castes and Scheduled Tribes for reservations, or what is commonly referred to as “quota within quota” for SCs and STs.

About sub-categorisation of SCs?

- Sub categorization of SCs is the division of Scheduled castes into various categories ie further division of scheduled caste for providing quota within quota.

- States have argued that among the Scheduled Castes, there are some that remain grossly under-represented despite reservation in comparison to other Scheduled Castes. This inequality within the Scheduled Castes is underlined in several reports, and special quotas have been framed to address it. Sub-categorisation of SCs is providing representation to those SCs that remain grossly under-represented despite reservation in comparison to other Scheduled Castes.

Previous Supreme Court Verdict on the Sub categorisation Context

- In EV Chinnaiah, a five-judge bench considered the validity of an Andhra law that further divided the list of Scheduled Castes into 4 categories — A, B, C and D. The 15 per cent reservation for Scheduled Castes in educational institutions and government jobs was then differently divided among these categories — 1 per cent for Group A, 7 per cent for Group B, 6 per cent for Group C and 1 per cent for Group D.

- Declaring this law as unconstitutional in 2004, the Supreme Court held that any further classification within the Scheduled Castes list notified by the President under Article 341 would amount to tinkering with the notification.

- The court had called the Presidential list “homogenous” and said only Parliament can exclude a caste or a part or group of castes from this list.

- Sub-classification, it further said, would violate Article 14 of the Constitution as it would “tantamount to discrimination in reverse”.

- The court had held that special protection of SCs is based on the premise that “all Scheduled Castes can and must collectively enjoy the benefits of reservation regardless of interse inequality” because the protection is not based on educational, economic or other such factors but solely on those who suffered untouchability.

Background of the Current Case

- In the latest judgment, the question before the Supreme Court was on the constitutional validity of Section 4(5) of the Punjab Scheduled Caste and Backward Classes (Reservation in Services) Act, 2006.

- The provision said 50 per cent of the seats reserved for Scheduled Castes would be offered to Balmikis and Mazhabi Sikhs, subject to their availability, by providing them preference from among the Scheduled Castes candidates.

- A two-judge bench of the Punjab and Haryana High Court had struck down the provisions as unconstitutional on 29 March 2010, relying on the Supreme Court judgment in EV Chinnaiah case.

- The High Court held that all the castes in the Presidential Order under Article 341 (1) of the constitution formed one class of the homogeneous group and the same could not be further sub-classified.

- The Court observed that any such legislation entry in the Seventh Schedule to the Constitution would be a violation of Article 14 of the Constitution.

Supreme Court Verdict in the current Case

- Supreme court Bench has ruled in favour of giving preferential treatment to certain Scheduled Castes over others to ensure equal representation of all Scheduled Castes.

- A five-judge constitution bench of Supreme Court observed that there can be sub classifications within scheduled castes (SCs) and scheduled tribes (STs) for granting them reservation; it disagreed with another Supreme Court verdict on the subject delivered in 2005.

- According to the bench since state governments have powers to make reservations, they also have the powers to make further sub-classifications in the reservation list.

Issues in the EV Chinniah Case according to the bench

- The Supreme Court bench has suggested a revisit of the 2004 decision of a coordinate bench of E V Chinnaiah vs State of Andhra Pradesh.

- The judges also expressed their view that ‘EV Chinniah’ did not correctly apply the decision of ‘Indira Sawhney’.

- The judges stated that the amendment to Article 342A of the Constitution was also not taken into account in the 2004 EV Chinniah decision.

Clash of Two verdicts

- While the Bench ruled in favour of giving preferential treatment to certain Scheduled Castes over others to ensure equal representation of all Scheduled Castes, it referred the issue to a larger Bench to decide. This was because in a 2005 ruling, also by a five-judge Bench, the Supreme Court had ruled that state governments had no power to create sub-categories of SCs for the purpose of reservation.

- Since a Bench of equal strength (five judges in this case) cannot overrule a previous decision, the court referred it to a larger Bench to settle the law.

- The larger Bench of 7 whenever it is set up by the Chief Justice of India, will reconsider both judgments.

What will larger bench look into

- The larger bench will look at the interpretation of Articles 14 (equality before law), 15, 16, 338, 341, 342, and 342A of the Constitution.

- Article 341 of the Constitution empowers the President to notify the “castes, races or tribes or parts of or groups within castes, races or tribes” that will be considered as Scheduled Castes in a state or a union territory. For states, the President is also required to consult with the Governor before issuing the notification.

- Clause 2 of Article 341 says Parliament can make a law to include or exclude any caste or tribe from this list.

- Similar provisions have been made for the Scheduled Tribes under Article 342 and for socially and educationally backward classes under Article 342A.

- Articles 15(4) and 16(4) allow the government to make special provisions for reservation in admissions in higher academic places and appointments, for those communities which are socially, educationally backwards classes or are from Scheduled Castes or Scheduled Tribes and in the opinion of the state are not adequately represented in the services under the state.

- Article 338 provides for the constitution of a National Commission for Scheduled Castes, which makes recommendations on the measures that should be taken by the Centre or the states for the SCs.

What are the grounds for sub-categorisation?

- Trickling down of benefits : The basis of special protections for SCs is that all these castes have suffered social inequity. Untouchability was practised against all these castes irrespective of economic, education and other such factors. The whole object of reservation is to see that backward classes of citizens move forward so that they may march hand in hand with other citizens of India on an equal basis. This will not be possible if only some section within that class gets the benefit leaving the rest of the class as backward as they always were, hence the benefits should trickle down to weakest of the weak

- Creamy layer within SCs : The concept of a “creamy layer” within SCs was upheld by the court in a 2018 judgment in Jarnail Singh v Lachhmi Narain Gupta. The central government has sought a review of the 2018 verdict and the case is currently pending.

- Equitable representation : The states have argued that the classification is done to provide an equitable representation of all SCs in government service and would bring about “real equality” or “proportional equality”.

What are the arguments against sub-categorisation?

- State of Kerala v N M Thomas, 1976: In the case the Supreme Court had laid down that “Scheduled Castes are not castes, they are class.” So test or requirement of social and educational backwardness cannot be applied to Scheduled Castes and Scheduled Tribes as the special treatment is given to the SCs is due to social discrimination which they suffer.

- Vote bank appeasement: The change in the proportion of reservation can also be used in the future for the appeasement of one vote-bank or the other. A watertight President’s list was envisaged to protect from such potential arbitrary change.

- 2018 ruling in Jarnail Singh: The 2018 ruling in Jarnail Singh which talked about the social inequities that exist among SCs is still pending for review and should not be relied on. In the Jarnail Singh case, the court held that the objective of reservation is to ensure that all backward classes march hand in hand and that will not be possible if only a select few get all the coveted services of the government.

Subcategorisation has been applied by several states

- In Andhra Pradesh, Punjab, Tamil Nadu and Bihar, special quotas were introduced for the most vulnerable Dalits.

- Bihar: In 2007 a Mahadalit Commission was set up to identify the castes within SCs that were left behind.

- Tamil Nadu: A 3% quota within the SC quota is accorded to the Arundhatiyar caste, after the Justice M S Janarthanam report stated that despite being 16% of the SC population in the state but held only 0-5% of the jobs.

- Andhra Pradesh: In 2000, the Andhra Pradesh legislature, based on the findings of Justice Ramachandra Raju, had passed a law reorganising 57 SCs into sub-groups and split the 15% SC quota in educational institutions and government jobs in proportion to their population. However, this law was declared unconstitutional in the 2005 Supreme Court ruling that held states did not have the power to tinker with the Presidential list that identifies SCs and STs.

- Punjab: Punjab too has had laws that gave preference to Balmikis and Mazhabi Sikhs within the SC quota but this was challenged and has eventually led to the latest ruling.

Presidential list

- The castes and tribes that are to be called Scheduled Castes and Scheduled Tribes is not mentioned in the constitution. It only provides for special treatment of SCs and STs to achieve equality

- According to the Constitution of India, under article 341(1), the President of India, after consultation with the Governor, may specify, “the castes, races, tribes or parts of groups within castes or races, which shall be deemed to be Scheduled Castes”. Accordingly, the President has notified the Scheduled Castes in the order called ‘Constitution (Scheduled Castes) Order-1950’ and the ‘Scheduled Castes and Scheduled Tribes List (Modification) Order-1956.

- However, under article 341(2), the Parliament of India by law can include or exclude the above-mentioned groups from the list of the Scheduled Castes.

- Article 342 provides for specification of tribes or tribal communities or parts of or groups within tribes or tribal communities which are deemed to be for the purposes of the Constitution the Scheduled Tribes in relation to that State or Union Territory.

- The order was called as the Constitution (Scheduled Castes) Order, 1950. The complete list of castes and tribes was made on order of 1950 which had certain norms and criteria for inclusion of other community later. However the Scheduled tribe list was put in updation due to partition as it was very difficult to identify tribals as they were geographically isolated. Thus, the list of Scheduled tribe was completely updated by 1958 with 744 enlisted tribes.

- The Constitution treats all Schedule Castes as a single homogeneous group

Facts for Prelims

- A caste notified as SC in one state may not be a SC in another state. These vary from state to state. It is basically to prevent disputes as to whether a particular caste is accorded reservation or not.

- According to the annual report of the Ministry of Social Justice and Empowerment, there were 1,263 SCs in the country in 2018-19.

- No community has been specified as SC in Arunachal Pradesh and Nagaland, and Andaman & Nicobar Islands and Lakshadweep.

2 . Draft rules on the implementation of in-flight WiFi connectivity

Context : Action against travellers if WiFi rules are violated: DGCA

Details of the Draft

- The draft rules govern the use of portable electronic devices to access the Internet during a flight.

- The proposed rules state the electronic devices can only be used when an aircraft is at a height of 3,000 feet or above.

- Mobile phones, tablets and laptops can only be used in flight mode, while all other gadgets such as portable voice recorders, electronic entertainment devices and electric shavers need to be stowed away.

- Cabin crew, besides their other duties, during the flight shall keep a watch on the passengers to ensure compliance of the above requirements.

Actions on violation

- Air travellers could face punitive action from airlines if they do not follow rules on handling portable electronic devices such as smartphones and laptops.

- Any violation of these requirements during the flight should be brought to the notice of the Commander by the cabin crew and recorded in the flight report book for subsequent action by the operator against the defaulting person,” according to the draft rules made public on Wednesday.

3 . Impact of Lock down on Women entrepreneurs

Context: The Consortium of Indian Associations, a forum representing more than 30 associations in India — including the all-India level women trade bodies such as the Federation of Indian Women Entrepreneurs, All India Hair and Beauty Association, Consortium of Women Entrepreneurs of India and ITF-Industry and Trade Forum — have requested Mala Sarat Chandra to conduct a survey on the impact and make recommendations to the government.

Women Entrepreneurs in India

- The number of women-owned enterprises is about 12% of the total micro, small and medium enterprises (MSME) in India

Issues faced by women entrepreneurs amid the COVID-19 lockdown

- Women entrepreneurs experienced significant reduction in sales and revenues amid the COVID-19 lockdown.

- As many women-owned enterprises were in the informal sector they could not easily avail the benefits of government- or public-assistance programmes.

- Transport restrictions had disrupted receipt of input material and delivery of products

- Women even faced increased responsibility for domestic care, increased social pressures and limited family support

Suggestions made

- The report has urged the government to bring access to finance for women entrepreneurs under priority sector lending and also enable loans at concessional rates, grant tax holidays, create a mentor network and enable them to be a vendor to public sector units and government departments.

- It has also sought the creation of a separate industrial estate for them.

4 . GST Compensation

Context: The 41st GST council meeting was held to discuss the GST revenue gap ₹3 lakh crore the states are likely to face this year.

Background

- With Centre-state friction over pending compensation payments under the Goods and Services Tax (GST) taking a new turn in the 41st GST Council meeting, strain on the finances of states is likely to continue in the near term.

- Several states have opposed the two options to borrow that were proposed in the meeting as a way to bridge the revenue shortfall.

- GST compensation payments to states have been pending since April, with the pending amount for April-July estimated at Rs 1.5 lakh crore. The GST compensation requirement is estimated to be around Rs 3 lakh crore this year, while the cess collection is expected to be around Rs 65,000 crore – an estimated compensation shortfall of Rs 2.35 lakh crore.

What was discussed at the meeting?

- The legal opinion on borrowing was discussed. The opinion of the Attorney General of India was cited to buttress the argument that GST compensation has to be paid for the transition period from July 2017 to June 2022, but the compensation gap cannot be bridged using the Consolidated Fund of India.

- The AG has suggested the compensation cess levy can be extended beyond five years to meet the shortfall

- State Finance Ministers, barring a few including those of Assam and Goa, pressed for borrowing by the Centre to bridge the revenue gap. Towards the end of the meeting, the Centre offered two options.

- The first was a special window to states, in consultation with the RBI, to borrow the projected GST shortfall of Rs 97,000 crore, and an amount that can be repaid after five years of GST, ending June 2022, from the compensation cess fund. A 0.5% relaxation in the borrowing limit under The Fiscal Responsibility and Budget Management (FRBM) Act would be provided, delinked from the conditions announced earlier as part of the pandemic package linked to the implementation of reform measures such as universalisation of ‘One Nation One Ration Card’, ease of doing business, power distribution, and augmentation of urban local body revenues.

- The second option was to borrow the entire projected shortfall of Rs 2.35 lakh crore – both on account of faltering GST collections and the expected shortfall due to the pandemic – facilitated by the RBI. No FRBM relaxation has been mentioned for this option so far.

What are the views of the states on these?

- Five states and Union Territories – Kerala, Punjab, West Bengal, Puducherry and Delhi – have voiced their concerns over the proposals.

- States have asked the Centre for details of the two options. They will then have seven working days to get back with their views.

What is the significance of GST for states?

- States no longer possess taxation rights after most taxes, barring those on petroleum, alcohol, and stamp duty, were subsumed under GST. GST accounts for almost 42% of states’ own tax revenues, and tax revenues account for around 60% of states’ total revenues.

- Finances of over a dozen states are under severe strain, resulting in delays in salary payments and sharp cuts in capital expenditure outlays amid the pandemic-induced lockdowns and the need to spend on healthcare.

- The Finance Secretary said GST collections had been severely impacted by the pandemic. Revenues are expected to be hit further; the economy is projected to record a recession this year. Union Finance Minister Nirmala Sitharaman on Thursday referred to the Covid-19 outbreak as an “act of God” that would result in a contraction of the economy in the current fiscal.

When did the issue of compensation to states arise, and how did it evolve?

- Shortfall issues surfaced almost a year ago when payments due for August-September 2019 were delayed. Since then, all subsequent payouts have seen cascading delays.

- The economic slowdown, which has been on for almost three years now, began to impact GST revenue collections in August 2019. The Centre first admitted to problems on compensation payment in the 37th GST Council meeting in Goa last September – it said the amount of cess available in the compensation fund at the end of February “shall fall short for payment of compensation for loss of revenue till the bi-monthly period of December-January”.

- On November 27, 2019, the GST Council wrote to states that the GST and compensation cess collections in the previous few months had become a “matter of concern”, and that compensation requirements were “unlikely to be met”.

- GST compensation payments had started getting delayed by then. Many state FMs had begun to express concerns over having to repeatedly ask for their share of revenues. The GST compensation payment of Rs 35,298 crore for August-September 2019, which was due in October, was paid in December. The Centre released another Rs 34,053 crore in two instalments in February 2020 and April 2020 as compensation for October-November 2019.

- In June this year, Rs 36,400 crore was released as GST compensation for December-February, and the balance Rs 13,806 crore for March was released in July, taking the total compensation payout for FY20 to Rs 1.65 lakh crore.

About GST compensation to States

- Under The GST (Compensation to States) Act, 2017, states are guaranteed compensation for loss of revenue on account of implementation of GST for a transition period of five years (2017-22). The compensation is calculated based on the difference between the states’ current GST revenue and the protected revenue after estimating an annualised 14% growth rate from the base year of 2015-16.

- The high rate of 14%, which has compounded since 2015-16, has been seen as delinked from economic realities. Chairing the first few meetings of the GST Council, then Finance Minister Arun Jaitley had proposed a revenue growth rate of 10.6% (the average all-India growth rate in the three years preceding 2015-16). Council meeting records show the suggestion of 14% revenue growth was accepted “in the spirit of compromise”.

About Compensation Cess

- Goods and Services Tax (Compensation to States) Act, 2017 was enacted to levy Compensation cess for providing compensation to the States for the loss of revenue arising on account of implementation of the goods and services tax with effect from the date from which the provisions of the Central Goods and Services Tax Act is brought into force for a period of five years or for such period as may be prescribed on the recommendations of the GST Council.

- The compensation cess on goods imported into India shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975, at the point when duties of customs are levied on the said goods under section 12 of the Customs Act, 1962, on a value determined under the Customs Tariff Act, 1975.

- Compensation Cess will not be charged on goods exported by an exporter under bond and the exporter will be eligible for refund of input tax credit of Compensation Cess relating to goods exported.

- In case goods have been exported on the payment of Compensation Cess the exporter will be eligible for refund of Compensation Cess paid on goods exported by him.

- Compensation cess shall not be leviable on supplies made by a taxable person who has decided to opt for composition levy.

5 . Great Andaman tribe

Context : 5 members of Great Andaman tribe test positive

About Great Andamanese tribe

- Great Andamanese tribe is one of the five Particularly Vulnerable Tribal group (PVTG) that reside in the Andamans archipelago.

- Just 74 Great Andamanese are left.

- They speak Jeru language among themselves.

- The five PVTGS residing in Andamans are Great Andamanese, Jarawas, Onges, Shompens and North Sentinelese.

- The Onge tribe reside primarily on the Dugong Creek of the Little Andaman Island.

- The Shompen and North Sentinelese live in isolation.

About Particularly Vulnerable Tribal Groups (PVTGs)

- PVTGs are more vulnerable amongst the tribal groups, hence in 1975, the Government of India initiated to identify the most vulnerable tribal groups as a separate category called PVTGs and declared 52 such groups, while in 1993 an additional 23 groups were added to the category, making it a total of 75 PVTGs out of 705 Scheduled Tribes, spread over 17 states and one Union Territory (UT), in the country (2011 census).

- Currently there are 75 tribal groups have been categorized by the Ministry of Home Affairs as Particularly Vulnerable Tribal Groups (PVTG)s.

- PVTGs reside in 18 States and UT of A&N Islands.

- For the identification of PVTGs the state governments or UT governments submit proposals to the Central Ministry of Tribal Welfare for identification of PVTGs. After ensuring the criteria is fulfilled, the Central Ministry selects those groups as PVTGs.

- Among the 75 listed PVTG’s the highest number are found in Odisha

How they are identified

- The criteria for identifying Particularly Vulnerable Tribal Groups are: –

- Pre-agricultural level of technology

- Low level of literacy

- Economic backwardness

- A declining or stagnant population

- According to the procedure, the state governments or UT governments submit proposals to the Central Ministry of Tribal Welfare for identification of PVTGs. After ensuring the criteria is fulfilled, the Central Ministry selects those groups as PVTGs.

Characteristics

- In 1973, the Dhebar Commission created Primitive Tribal Groups (PTGs) as a separate category, who are less developed among the tribal groups.

- In 2006, the Government of India renamed the PTGs as Particularly Vulnerable Tribal Groups (PVTGs).

- PVTGs have some basic characteristics -they are mostly homogenous, with a small population, relatively physically isolated, social institutes cast in a simple mould, absence of written language, relatively simple technology and a slower rate of change etc

Scheme for PVTGs

- Development of Particularly Vulnerable Tribal Groups (PVTGs): this scheme is implemented by the Ministry of Tribal Affairs exclusively for PVTG. Under the scheme, Conservation-cum-Development (CCD)/Annual Plans are to be prepared by each State/UT for their PVTGs based on their need assessment, which are then appraised and approved by the Project Appraisal Committee of the Ministry. Activities for development of PVTGs are undertaken in Sectors of Education, Health, Livelihood and Skill Development , Agricultural Development , Housing & Habitat, Conservation of Culture etc.

6 . Wolbachia Bacteria

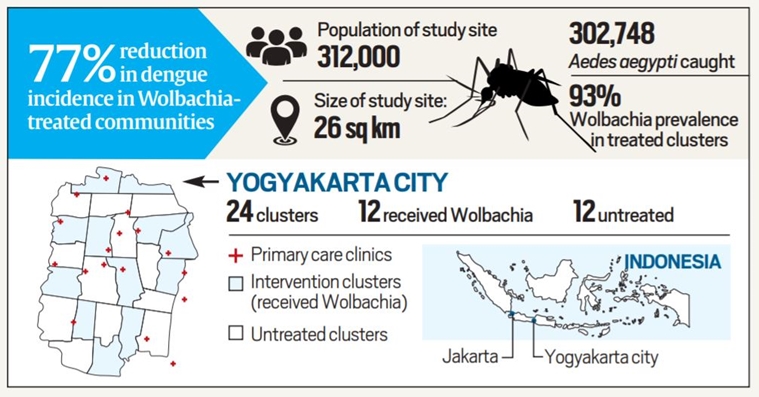

Context : Two years ago, researchers infected mosquitoes with bacteria and released them into parts of an Indonesian city. On Wednesday, they announced the results of their unique experiment: In areas where such mosquitoes were deployed. dengue incidence was 77% lower than in areas where they were not. These findings have implications for combating dengue on a larger scale, and possibly other mosquito-borne diseases.

How can mosquitoes bring down dengue, which is spread by mosquitoes?

- The key to this is a bacterium, Wolbachia, which occurs naturally in some species of insects.

- While such insects include some mosquitoes, Wolbachia does not occur naturally in Aedes aegypti, the mosquito species that spreads dengue and other diseases such as chikungunya, Zika and yellow fever.

- In 2008, the Australian-based research group World Mosquito Program (WMP) discovered that Aedes aegypti mosquitoes can no longer spread dengue when they are carrying Wolbachia, this is because the dengue virus struggles to replicate inside the mosquito when these bacteria are present.

But will people not be infected when other mosquitoes bite?

- The reasoning is that once you release mosquitoes carrying the Wolbachia bacteria, they will interbreed with the local wild mosquitoes. Over time, several generations of mosquitoes will be carrying Wolbachia naturally.

- A stage will eventually be reached when those carrying Wolbachia represent a large proportion of the local mosquito population, so that a bite is less likely to transmit the virus to humans.

Research Findings

7 . Facts for Prelims

National Broadcasting Association (NBA)

- It represents the private television news & current affairs broadcasters.

- It is the collective voice of the news & current affairs broadcasters in India .It is an organization funded entirely by its members.

- The NBA has presently 25 leading news and current affairs broadcasters (comprising 47 news and current affairs channels) as its members.

- The NBA presents a unified and credible voice before the Government, on matters that affect the growing industry.